1)the creditor reasonably contemplates repeated transactions; If this is a variable rate loan, the loan amount section as set forth in the closed end loan disclosure statement tells you whether, if the interest rate increases, you will have to make more payments, higher payments, or if the final payment will be a balloon payment.

What Is A Closing Disclosure Lendingtree

2)the creditor may impose a finance charge from time to time on an outstanding unpaid balance;

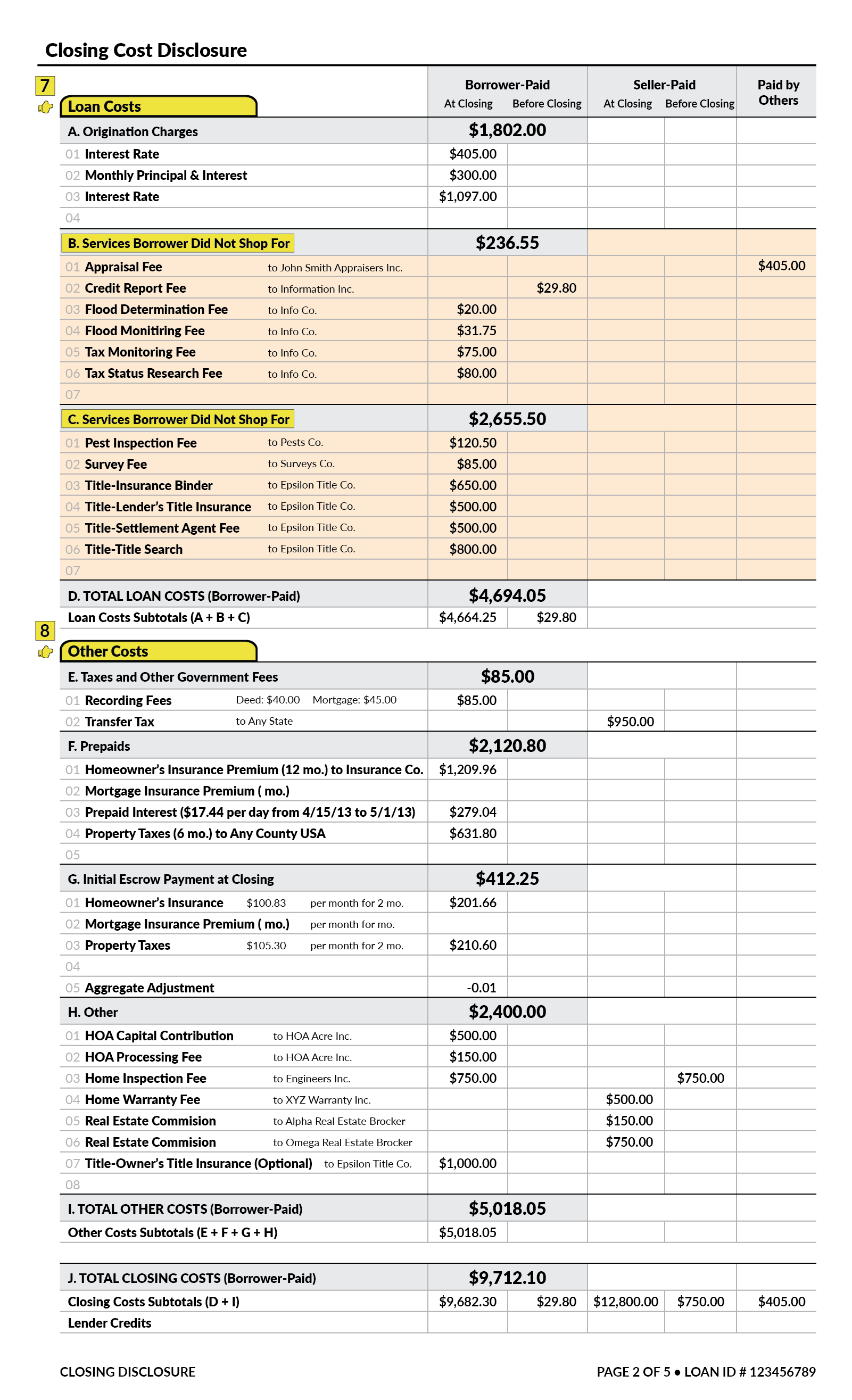

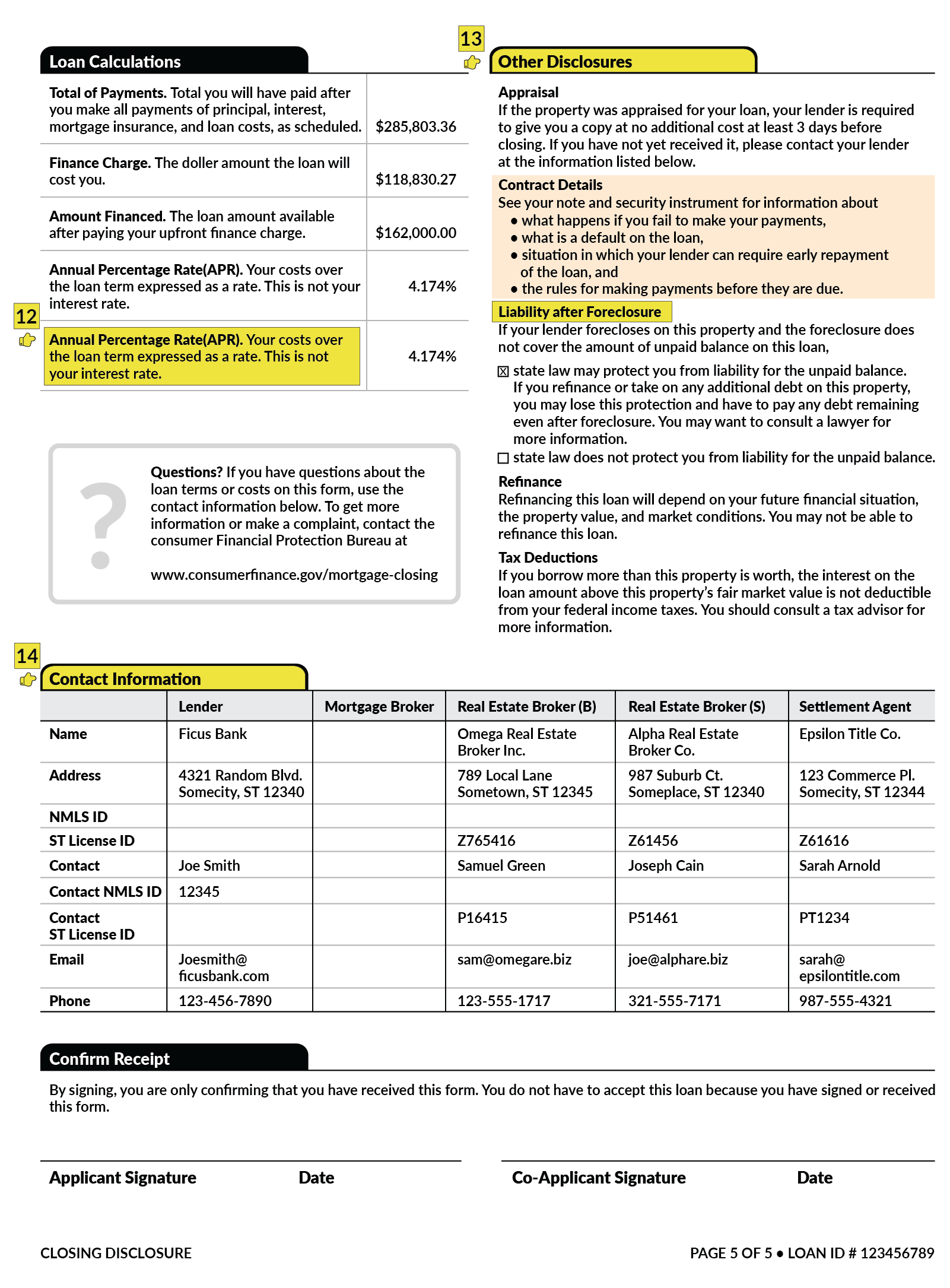

Closed end credit disclosures. The closing disclosure must be in writing and Creditors may use the model credit insurance disclosures only if the debt cancellation coverage constitutes insurance under state law. The terms "finance charge" and "annual percentage rate" and corresponding rates or amounts should be more conspicuous than

And 3)the amount of credit extended during the term of the plan is generally made available. The annual percentage rate,using that term spelled out in full. 226.8 is the principal section for closed end credit disclosures.

The creditor may state other annual or periodic rates that are applied to an unpaid balance, along with the required annual percentage rate. For terminated loans subject to 2 above, an adjustment will not be ordered if the violation occurred in a transaction consummated more than two years prior to the date of the current examination. The disclosures required under subsection (a) with respect to any open end consumer credit plan which provides for any extension of credit which is secured by the consumer's principal dwelling and the pamphlet required under subsection (e) shall be provided to any consumer at the time the creditor distributes an application to establish an account under such plan to such consumer.

For residential mortgages and extensions of credit secured by the member's dwelling, the disclosures must be provided within three (3) business days after receiving the If the annual percentage rate may be increased after consummation of credit. Disclosure section of the closed end loan disclosure statement.

Creditors may provide a disclosure that refers to debt cancellation or debt suspension coverage whether or not the coverage is considered insurance. 1026.22—determination of annual percentage rate. In an advertisement for credit secured by a dwelling , when any series of payments varies because of the inclusion of mortgage insurance premiums, a creditor

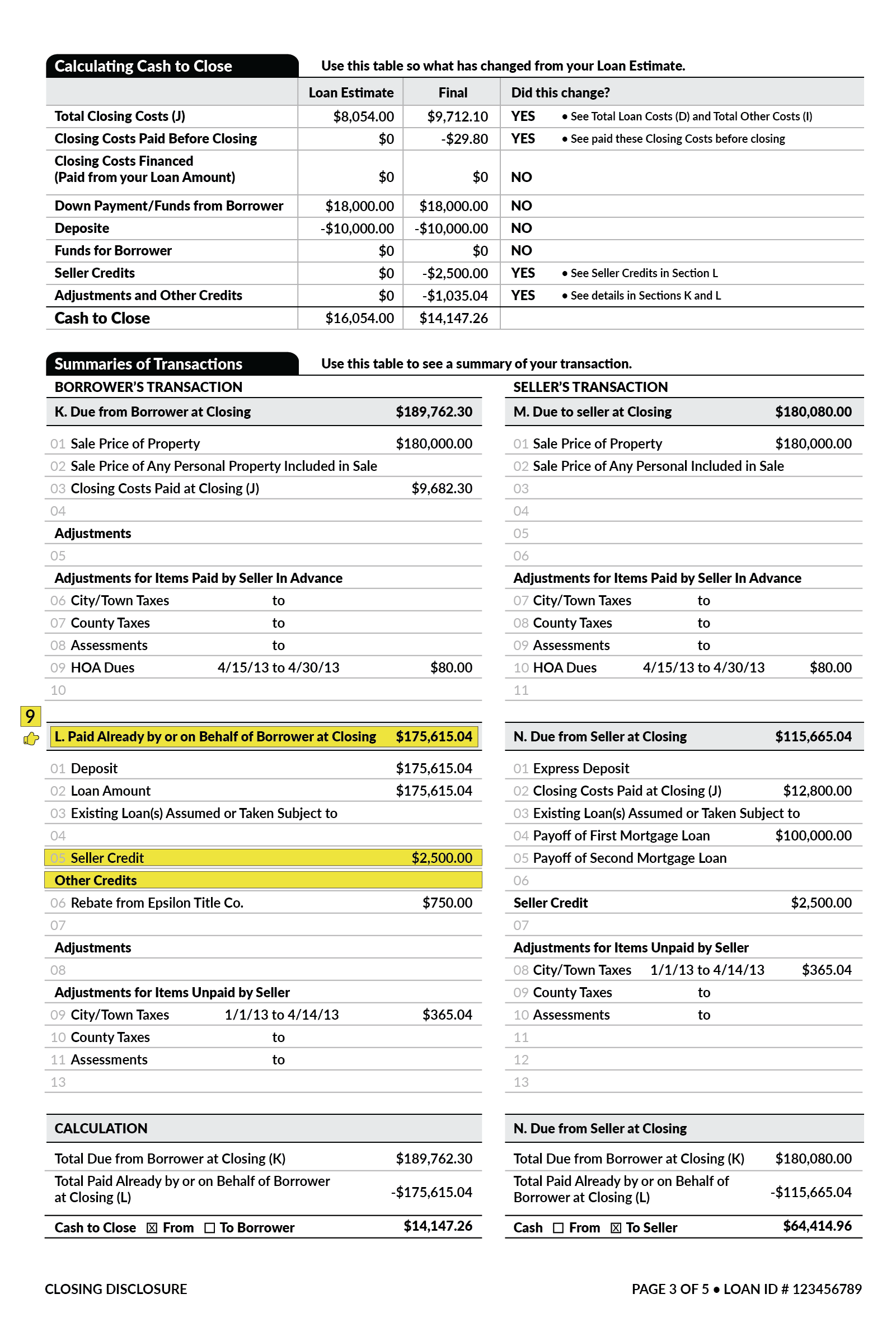

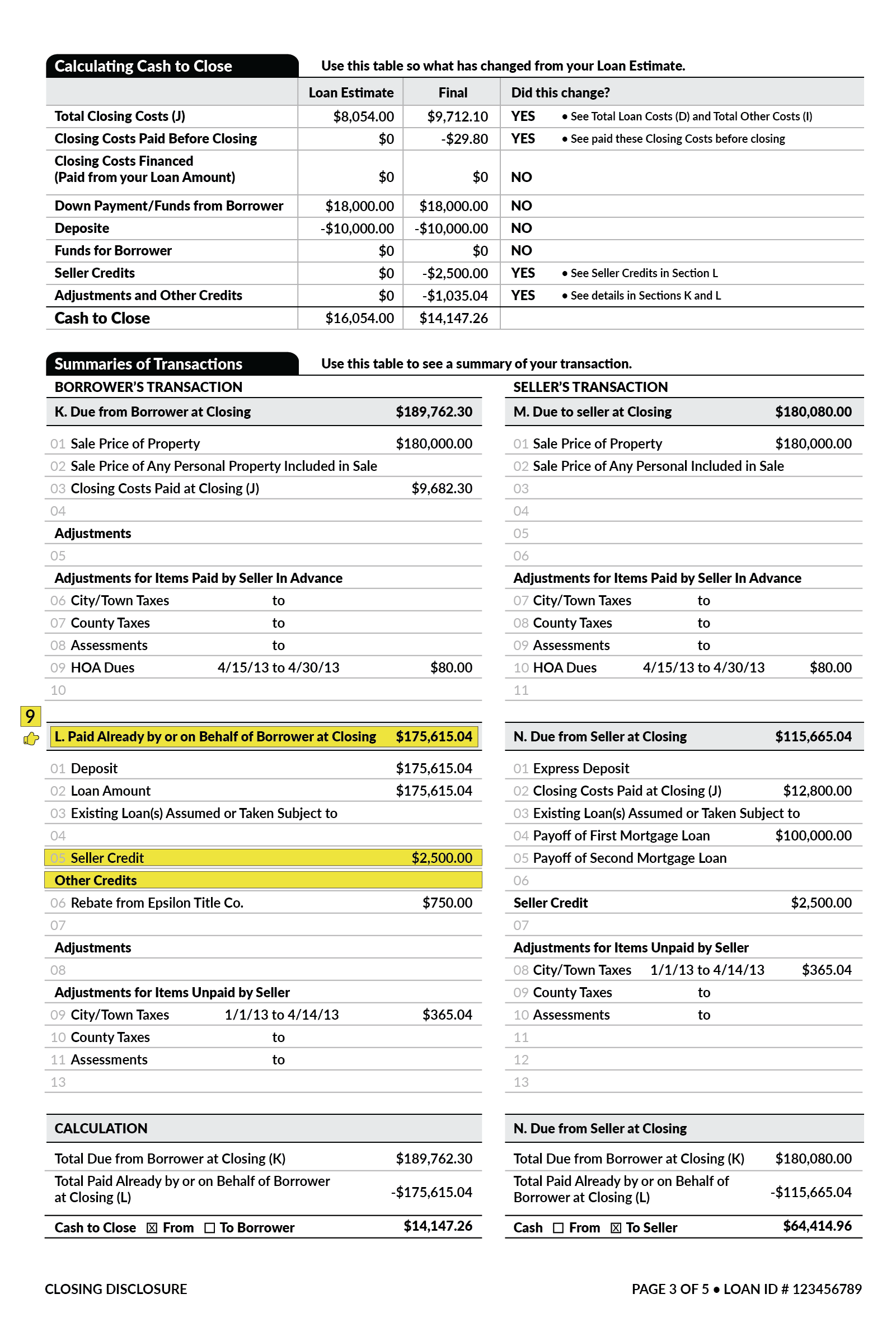

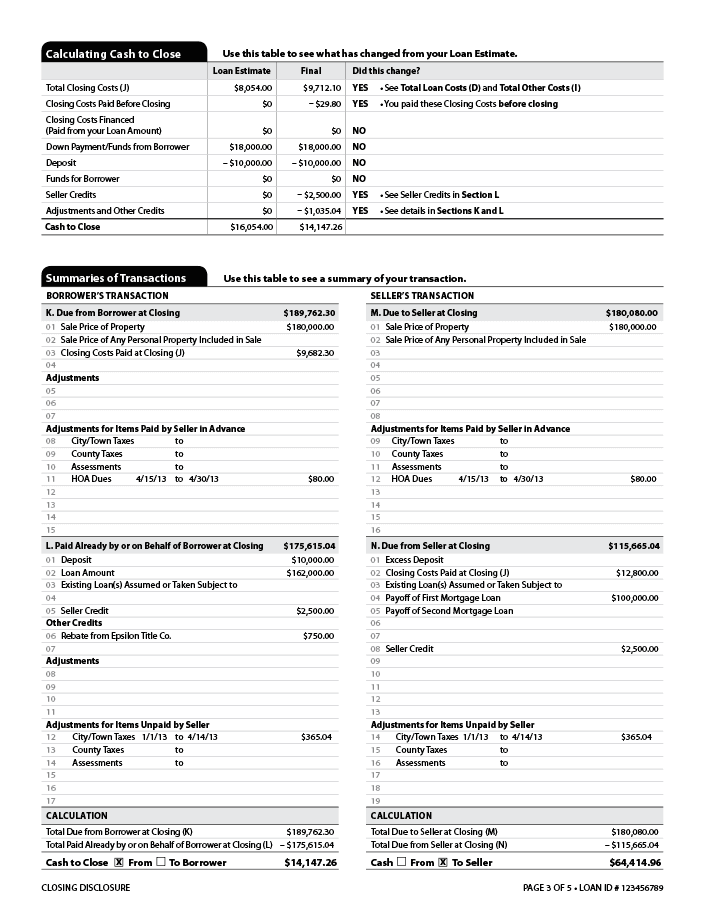

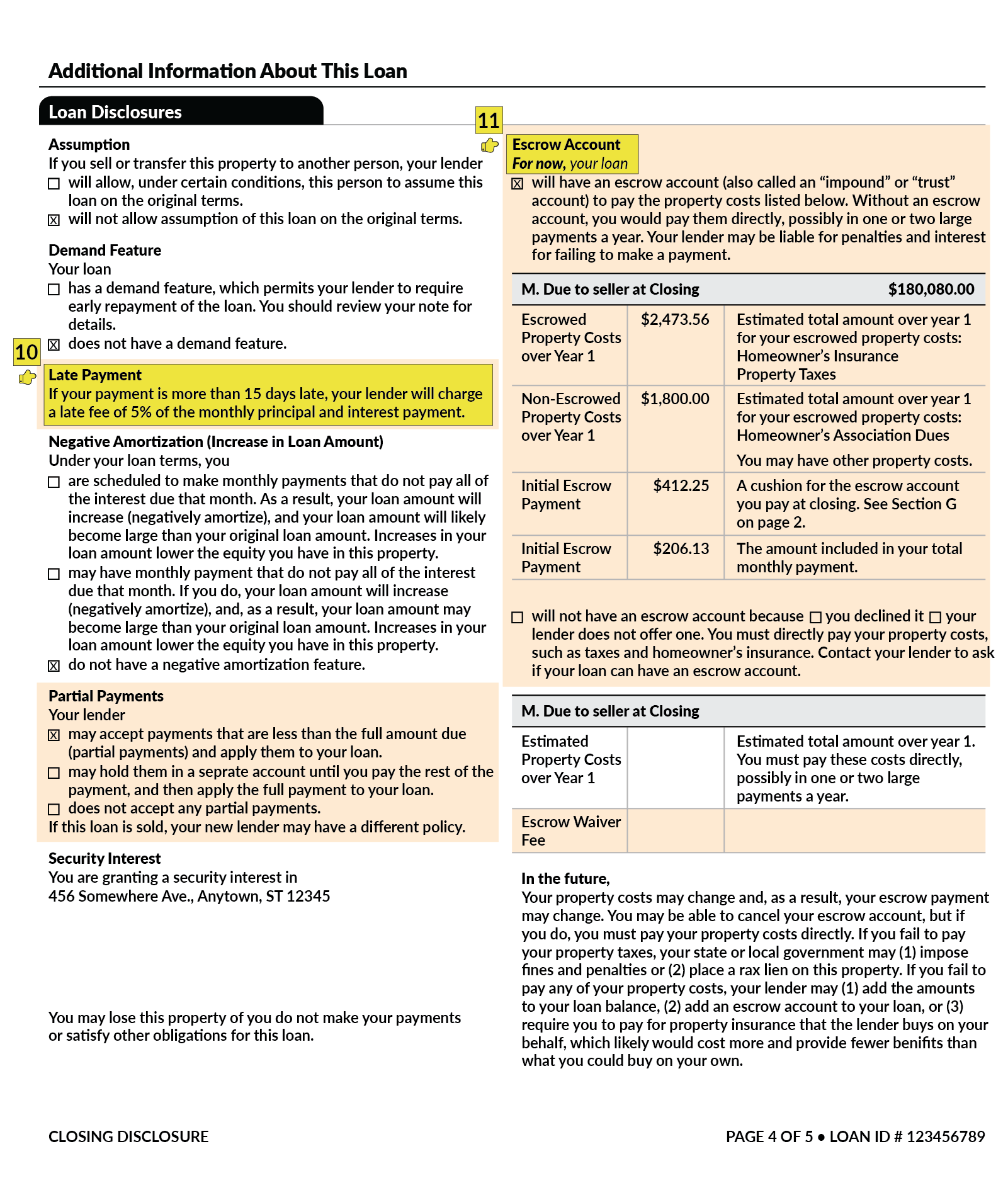

The loan estimate is provided within three business days from application, and the closing disclosure is provided to consumers three business days before loan consummation. The amount or percentage of the down payment; Information that may be given.

In most cases, the extension of this type of credit involves the accrual of finance charges and interest that are also considered due at the same time that the full principal is settled. Determine that the disclosures are clear, conspicuous, and grouped together or segregated as required, in a form the consumer may keep. Disclosures under tila and respa sections 4 and 5.

Appendix G To Part 1026 Open-end Model Forms And Clauses Consumer Financial Protection Bureau

Mandatory Disclosures To Consumer

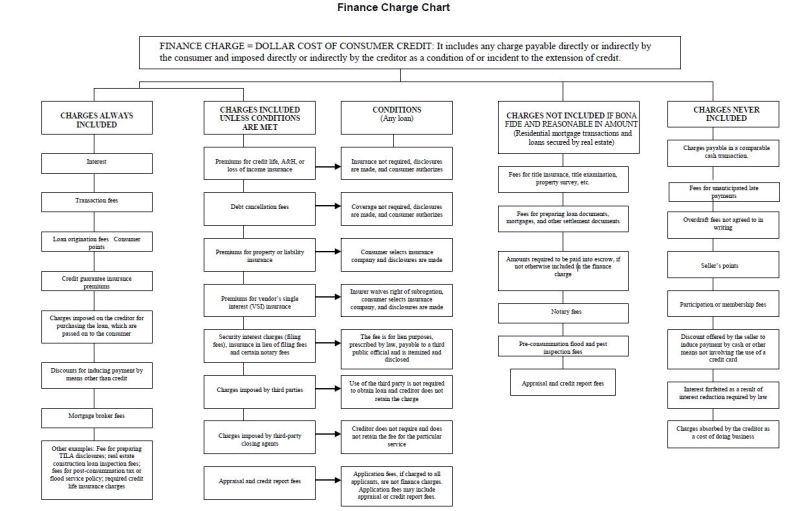

Consumer Compliance Outlook-understanding Finance Charges For Closed-end Credit Implementing The Consumer Compliance Rating System Nafcu

Fdic Law Regulations Related Acts - Consumer Financial Protection Bureau

Appendix G To Part 1026 Open-end Model Forms And Clauses Consumer Financial Protection Bureau

Understanding Finance Charges For Closed-end Credit

What Is A Closing Disclosure Lendingtree

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed-end Credit Vs An Open Line Of Credit

Appendix G To Part 1026 Open-end Model Forms And Clauses Consumer Financial Protection Bureau

What Is A Closing Disclosure Lendingtree

Fdic Law Regulations Related Acts - Consumer Financial Protection Bureau

What Is A Closing Disclosure Lendingtree

Military Lending Act Disclosure Form

The Loan Estimate And Closing Disclosure What They Mean - Nerdwallet

2

What Is A Closing Disclosure Lendingtree

How To Comply With The Closing Disclosures Three-day Rule - Alta Blog

Military Lending Act Disclosure Form

Truth In Lending Act Tila Consumer Rights Protections

Closed End Credit Disclosures. There are any Closed End Credit Disclosures in here.